In today's competitive insurance landscape, maximizing operational effectiveness is paramount. SAS Policy Value Hub Services offer a powerful solution for insurers to realize these objectives by providing a centralized platform for managing policy data and workflows. With its robust capabilities in integration, SAS Policy Value Hub empowers insurance organizations to reduce costs, boost customer service, and accelerate key business processes.

- Harnessing advanced analytics, SAS Policy Value Hub enables insurers to identify valuable insights from policy data, leading to enhanced risk assessment and underwriting decisions.

- Efficient policy administration processes reduce manual effort, free up staff resources, and eliminate the potential for errors.

- Enhanced customer engagement through personalized communications

SAS Policy Value Hub Services provide a comprehensive suite of tools and functionalities that cater the diverse needs of insurance organizations. From policy underwriting to claims processing, SAS Policy Value Hub delivers a unified platform for end-to-end automation. By embracing these innovative solutions, insurers can transform their operations and succeed in the evolving insurance market.

Optimizing Insurance Policy Management with SAS

In the dynamic world of insurance, effective policy management is crucial for profitability. SAS, a leading analytics platform, empowers insurers to streamline their policy processes and achieve improved outcomes. By leveraging SAS's robust capabilities, insurers here can automate workflows, gain actionable insights from data, and offer a more customized customer experience.

Employing Data Analytics for Enhanced Insurance Policy Valuation

Data analytics has emerged as a transformative tool in the insurance industry, offering valuable knowledge that can significantly optimize policy valuation. By analyzing vast datasets of customer information, insurers can gain a deeper awareness of risk profiles and patterns. This allows for enhanced accurate determination of policy rates, leading to fairer pricing strategies.

Furthermore, data analytics can uncover possibilities for cost reduction by enhancing underwriting procedures. By harnessing predictive techniques, insurers can better forecast future claims, minimizing financial exposure.

Ultimately, the adoption of data analytics in policy valuation facilitates insurers to make strategic decisions, leading to enhanced profitability, customer loyalty, and a more competitive advantage.

Insurance Companies Policy Value Hub: A Comprehensive Solution

The SAS Policy Value Hub offers a robust solution for enhancing insurance operations. This advanced platform empowers providers to efficiently assess policy value, identify growth opportunities, and enhance profitability. With its integrated suite of tools, the SAS Policy Value Hub facilitates data-driven planning, minimizing operational costs and enhancing customer loyalty.

- Leveraging advanced analytics, the SAS Policy Value Hub provides insightful information into policy performance, helping insurers to identify trends

- Automating the policy administration process minimizes manual effort and enhances efficiency.

- Real-time reporting provides a clear view of operational metrics

Driving Value and Efficiency in Insurance Through SAS Technology

The insurance industry is constantly evolving, facing mounting pressure to improve operations and deliver exceptional customer service. SAS technology provides a robust framework for insurers to attain these goals. By harnessing SAS's advanced analytics, predictive modeling, and data management capabilities, insurance companies can modernize their processes and drive significant value.

- For instance, SAS helps insurers effectively assess risk, tailor policies to individual needs, and detect potential fraud.

- Furthermore, SAS empowers insurers to enhance claims management, leading to rapid resolution times and greater customer satisfaction.

- Ultimately, SAS technology enables insurers to gain a competitive edge by performing more efficiently.

Empowering Insurance Providers with Real-Time Policy Insights from SAS

In the dynamic world of insurance, making data-driven decisions in real time is crucial for success. SAS empowers insurance providers with a comprehensive suite of tools and analytics to gain actionable insights from their policy data. By leveraging the power of SAS, insurers can streamline operations, mitigate risk, and ultimately provide a more personalized customer experience.

- Instantaneous Policy Insights: Gain immediate visibility into policy performance, identify trends, and detect potential issues before they escalate.

- Anti-Fraud Systems: SAS's advanced algorithms can detect fraudulent claims and activities in real time, safeguarding insurer profits and ensuring fairness.

- Customized Insurance Products: Use data to analyze customer needs and preferences, creating personalized insurance solutions that meet their specific requirements.

SAS empowers insurance providers with the tools they need to thrive in today's competitive landscape.

Michael Oliver Then & Now!

Michael Oliver Then & Now! Alisan Porter Then & Now!

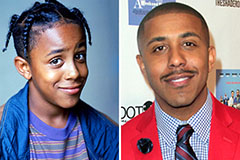

Alisan Porter Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!